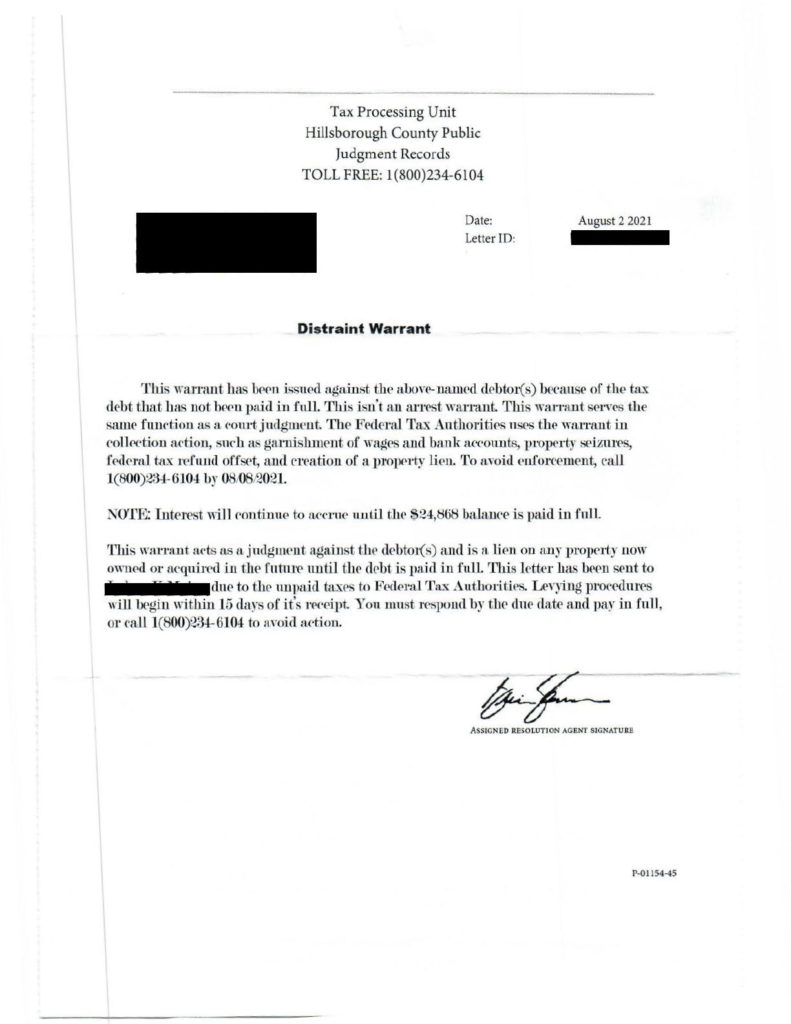

A client of our firm recently received a letter in the mail (see the image below) that was not so cleverly disguised as a scam. Still, an unsuspecting individual or someone not paying attention to the details might fall victim to such a scam so I’ve added this article as a public service. This scam involved a “Distraint Warrant.” Let’s take a look at this letter closely to see what exactly is going on here.

What is a Distraint Warrant?

A state can issue a warrant for the purpose of notifying a property owner that the property might be seized or sold based upon overdue taxes and expenses. In many states a distraint warrant is served by a sheriff. Some states, Massachusetts for example, go a step further and allow the debtor to be placed in jail if specific conditions are met. M.G.L. Chapter 60, Section 29.

While it may be possible for a person to receive a distraint warrant by mail, the warrant itself becomes questionable when it is not accompanied by in hand service from a sheriff or other service processor and when other necessary details are lacking in the letter. My hope is that if you are reading this article, you will not be fooled by such a letter.

Who Sent the Distraint Warrant?

These scammers begin the letter by calling themselves “Tax Processing Unit” presumably of Hillsborough County. My first clue was in the name itself. It is unlikely that any public or even private organization is going to name a division of their organization the Tax Processing Unit, and upon further investigation no such division exists in Hillsborough County New Hampshire. The name implies the author’s intention to give credibility to the letter, as if the recipient is going to be immediately impressed by receipt of something from the tax processing unit…must be important, right?

The second clue that this letter might be a scam came from the toll free number. By doing a simple reverse phone lookup search on the letter, I was able to discover that the phone number was not in the Whitepages database. A reputable company would be discoverable by doing a reverse phone lookup on the number.

What Was Correct in the Letter?

Here is where they get you! The letter may seem plausible because the letter named the exact address of the client. Keep in mind that the registry of deeds in the county in which a person owns property may have documentation such as tax liens, judgment liens, or other types of monies owed by a debtor and attached to a given piece of property. These documents can then be used to deduce the address of the person who will become a future target. If you know that you owe money to the IRS, a credit card company or some other creditor, and that creditor has a lien on property you own, a scammer may use this information to try to fool you.

The Meat and Potatoes

The body of the letter warns the reader that the warrant isn’t an arrest warrant, but is a warrant and that the letter is informing you of a judgment against you. The letter goes on to say that the “Federal Tax Authorities” uses the warrant to garnish wages, bank accounts, seize property, seize tax refunds, or create a lien on property. While it may be true that a state agency may be authorized by statute to issue a distraint warrant against a property owner or even a person, the agency issuing such a warrant would name itself. Here, the author of this distraint warrant scam letter implies that the “Federal Tax Authorities” are issuing such a lien, garnishment, or seizure of your property. However, the author does not name the authority. A legitimate notice from any state or federal agency, or even from a private company would include the precise name of the agency involved.

Red Flags All Over the Place

Similar to an “Act Now!” subliminal message heard in a car commercial offer, the author of this letter makes sure to write….”NOTE: Interest will continue to accrue until the …. balance is paid in full…” In other words, you better call the number on this letter right away or you will be charged a massive amount of interest.

More fear is placed on the reader with the next statement, “this letter has been sent to (insert your name here) due to unpaid taxes to Federal Tax Authorities…levying procedures will begin within 15 days of it’s receipt.” The purpose of this phrase is to again have the reader thinking that because you owe some money on unpaid taxes, the letter was sent to the mysterious Federal Tax Authority by the Tax Processing Unit of Hillsborough County. Why would a County agent be reporting you to federal tax authorities, who then give you 15 days before to pay the County before they decide to then take action? It is all very confusing language designed to seem authoritative and legitimate.

My personal favorite red flag is the apostrophe in the phrase, “Levying procedures will begin within 15 days of it’s receipt.” The word, it’s means it is, therefore, the sentence without the contraction would read, “levying procedures will begin within 15 days of it is receipt.” At least get the grammar correct in your scam if you are going to try to fool people.

A small detail, but the signature of the “Assigned Resolution Agent Signature” is missing a printed version of the same name. It is highly unusual for a signature to not be accompanied by a printed name in any legal document because that no one can be sure who actually signed the document if the signature cannot be read.

A Little Research

This same scam has been reported by the Erie County, NY, Consumer Protection division and numerous other government agencies. It is always a good idea to conduct some basic research on the internet by typing in the phone numbers to clarify the relationship between the agency sending a letter and the actual number given.

The Real Tragedy – Calling the Phone Number on the Letter

If not paying attention as the recipient of such a scam letter, one could easily fall for the trick the young man answering my call tried to play on me. The person answering my call asked me why I was calling. Playing innocent, I explained that I didn’t quite understand the letter, but it seemed like I owed some taxes to the IRS, but I couldn’t be sure. I told him that the balance that I saw on the letter, but that I didn’t know what that applied to. He then asked me if I owed any money to the IRS? I told him that I thought I did in the past and that I thought it was paid off. Then, he got right into the point of the scam, the largest indicator that he was trying to get information from me. He said, “I need to contact the IRS with you on the line. I’m going to hang up and call you right back from another phone, then you will have to identify yourself to the IRS agent after he or she gives you their badge number, and give him your address, social security number and other identifying information.” He actually added, “we want to keep this close to the vest, so you don’t need to give him too much information about me, just that I am helping you track down the amount of taxes that you owe.”

An unsuspecting or complaint person might have gone along with his request. He then would have called his associate who would have delivered a badge number as promised. If successful, the scammer has your name, phone number, address, and social security. Opening a credit card or other account is only a phone call away.

Don’t be a Victim

While you may think that you would not fall for such a scam, do not be so sure. The individual on the phone with me was very professional sounding, convincing, persuasive, and good at what he did. As always, trust your gut and if everything does not line up do not fall for this type of scam letter. If you have received such a letter of have other security concerns, feel free to contact our firm before you respond. A legitimate government agency or collection agency will clearly identify itself in the body of the letter, on the actual envelope sent through the mail, and will be much more upfront in any telephone communications with you.

DISCLAIMER:

The information provided in the pages and posts of this website are for general informational purposes only. The information presented on this site is not legal advice, and no attorney-client relationship is formed by the use of this site.