Massachusetts Bankruptcy Filers may be able to Keep Their Personal Car or Vehicle…

As a general point as to whether you may keep your car or other personal vehicle that you use to drive to and from work when you file for bankruptcy, you will likely be able to retain possession of your vehicle. But, there are a number of considerations that the car owner in Massachusetts must take into account when seeking an answer to the question of whether or not the bankruptcy petitioner may keep his or her car.

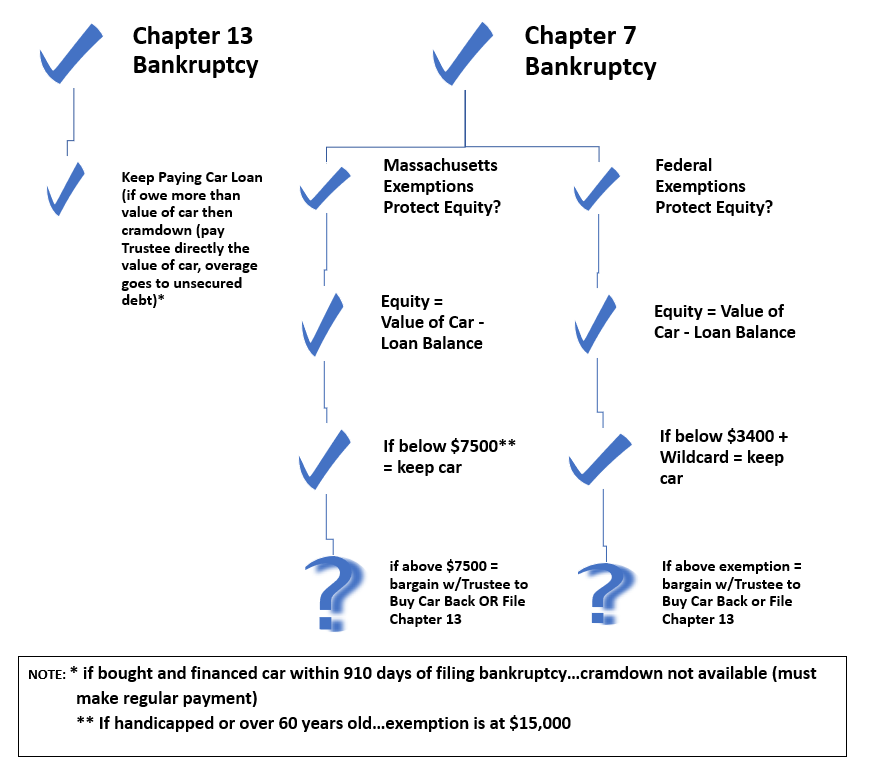

First, the bankruptcy filer must understand that both the lender (usually, a bank) that granted you the loan to purchase the car and potentially the bankruptcy trustee could have a stake in your car. The danger for the bankruptcy filer in Massachusetts wishing to keep his or her car arises when filing Chapter 7 bankruptcy because Chapter 7 is what is known as liquidation. In Chapter 7, or liquidation, your assets will be liquidated by the bankruptcy trustee to payoff debts…maybe. Luckily, there are exemptions that could protect you in Chapter 7 that will allow you to keep your car. More about this later.

Second, and this is really great news, if you choose to file Chapter 13 bankruptcy in Massachusetts, you will likely be able to keep your car. You can keep your car because Chapter 13 is a repayment plan chapter of the bankruptcy code. When you file Chapter 13 in Massachusetts you are agreeing to repay your debt over an extended period of time. Because any outstanding car loan that exists at the time you file Chapter 13 will be paid off over this repayment time period, there would be no reason for your car to be repossessed or removed from you. You may even be able to cramdown you payment if the amount you owe is greater than the value of the car. This cramdown may apply to you car if you are filing Chapter 13 in Massachusetts, you owe more than the car is worth, and you haven’t bought and financed the car within 910 days of filing bankruptcy. The bankruptcy judge in a cramdown case in Chapter 13 may allow you to only pay to the Trustee an amount equal to the value of the car, any amount owed greater than that value will go towards your unsecured debt.

See the figure below for a visual example of how this all plays out:

Why an Attorney Can Help You in Bankruptcy

As is probably evident to you after reading this article, the bankruptcy process in Massachusetts under either Chapter 7 or Chapter 13 is fairly complex. While it may be fairly easy to determine which route is best to take in terms of filing (Chapter 7 or 13) as far as the matter of keeping your car is concerned, it becomes more confusing when adding the numerous other exemptions and exceptions to which property may be kept. For example, owning a home while filing for bankruptcy in Massachusetts poses a unique set of circumstances which will require you or your attorney to determine homestead filings, the amount of money you owe on your home, how current mortgage payments on the home are, and other matters. It is advisable to work with a competent attorney who understands the ins and outs of filing for bankruptcy in Massachusetts to achieve the best possible outcome.

There is Indeed Life After Bankruptcy

Aside from the social stigma associated with filing for bankruptcy in Massachusetts, there is usually inner turmoil experienced by anyone struggling with financial matters and the constant phone calls from creditors. The decision as to whether or not to file bankruptcy in these circumstances can be overwhelming. To help potential filers make this decision I ask you to think deeply about what your options are. Here is how we at this firm see it:

- You can do nothing

PROS: you may not worry (depending upon your personality type) for the time being

CONS: debt collectors continue aggressively to attempt to collect, you may be sued and have wage garnishment or bank accounts levied, you may become overwhelmed with emotions about your financial situation - You can locate a debt consolidation agency

PROS: some of your debt may be reduced resulting in lower amounts to payoff

CONS: there is no automatic stay which arises in debt consolidation, that is, there is no protection by law from creditors for these debts. As a result, a creditor may still sue you, even taking action such as wage garnishment, the levying of bank accounts, or any other legal method to recoup money owed them. - You file for Chapter 7 or Chapter 13 in Massachusetts

PROS: Begin the process of repaying your debt and rebuilding credit, feel confident that you are doing something positive to right the financial situation you are in

CONS: rebuilding credit will take time (more so in Chapter 7), but it can and has been done by many people

We wish you luck in forming a decision to file bankruptcy, or not to file bankruptcy, in Massachusetts. If we can be helpful in explaining your options and the potential outcomes we welcome you to call our offices and arrange for a free consultation on this matter.

Read More on the subject of filing bankruptcy in Massachusetts in the following articles:

Bankruptcy and Credit

Is Bankruptcy the Best Choice for a Massachusetts Resident?

Property Exempt in Bankruptcy

Before Filing For Bankruptcy – Foreclosure Basics

Chapter 13 Explained

Chapter 7 Explained

How Debt is Handled in Bankruptcy in Massachusetts

Massachusetts Bankruptcy FAQ’s

Consolidate Debt or Declare Bankruptcy in Massachusetts?

DISCLAIMER:

The information provided in the pages and posts of this website are for general informational purposes only. The information presented on this site is not legal advice, and no attorney-client relationship is formed by the use of this site.